NYT: Official Calls for Urgency on College Costs

“Three in four Americans now say that college is too expensive for most people to afford,” Mr. Duncan said. “That belief is even stronger among young adults — three-fourths of whom believe that graduates today have more debt than they can manage.”

"College seniors with loans now graduate with an average debt load of more than $25,000. With outstanding student debt nearing $1 trillion — and exceeding credit-card debt — it makes sense that, as Patrick M. Callan, president of the Higher Education Policy Institute, put it, college costs are in the spotlight as never before."

"Just before Thanksgiving, Occupy Wall Street spawned the Occupy Student Debt Campaign, which asks for zero interest on student debt, federally financed public higher education and the forgiveness of all existing debt. At Occupystudentdebtcampaign.com, the campaign asks donors to sign a Pledge of Refusal, which promises that when a million signatures have been gathered, all will cease to make their debt payments."

“It’s basically a strike threat, but it gives debtors, many of whom have gray hair at this point, a way to act collectively, rather than suffer the agony and isolation of their debt,” said Andrew Ross, a New York University professor who is one of the organizers of the campaign. “We think education is a right and a public good, and we think federal funding is the only way the United States can join the list of other countries that offer free public education.”

"College seniors with loans now graduate with an average debt load of more than $25,000. With outstanding student debt nearing $1 trillion — and exceeding credit-card debt — it makes sense that, as Patrick M. Callan, president of the Higher Education Policy Institute, put it, college costs are in the spotlight as never before."

"Just before Thanksgiving, Occupy Wall Street spawned the Occupy Student Debt Campaign, which asks for zero interest on student debt, federally financed public higher education and the forgiveness of all existing debt. At Occupystudentdebtcampaign.com, the campaign asks donors to sign a Pledge of Refusal, which promises that when a million signatures have been gathered, all will cease to make their debt payments."

“It’s basically a strike threat, but it gives debtors, many of whom have gray hair at this point, a way to act collectively, rather than suffer the agony and isolation of their debt,” said Andrew Ross, a New York University professor who is one of the organizers of the campaign. “We think education is a right and a public good, and we think federal funding is the only way the United States can join the list of other countries that offer free public education.”

WashPo: "Student debt will soon reach $1 trillion"

"The Federal Reserve Bank of New York says that overall consumer debt dropped about $60 billion, to $11.66 trillion, in the third quarter. But as consumers cut their mortgage and credit card debt, they apparently were loading up on student loans."

"In its August report, the New York Fed reported student loans outstanding at $550 billion. Its revised figure shows that in the second quarter, the amount outstanding was actually $845 billion — 53.7 percent higher than what was first reported. In the third quarter, total student-loan debt was $865 billion. These figures dwarf credit card debt, which was $694 billion in the second quarter and $693 billion in the third."

"The New York Fed report is only the latest to reach a certain conclusion: Student-loan debt is reaching incredible heights. Last year, total student-loan debt passed total credit card debt for the first time."

"Mark Kantrowitz, publisher of FinAid (www.finaid.org), one of the best sites for college financial aid information, has created a Student Loan Debt Clock at www.finaid.org/loans/studentloandebtclock.phtml. The clock is an estimate of current student-loan debt outstanding, including both federal and private student loans. My last check showed more than $960 billion."

"Here’s what concerns me: All the estimates point to a disturbing milestone. If families continue the current borrowing trend, total student-loan debt will soon reach $1 trillion."

"In its August report, the New York Fed reported student loans outstanding at $550 billion. Its revised figure shows that in the second quarter, the amount outstanding was actually $845 billion — 53.7 percent higher than what was first reported. In the third quarter, total student-loan debt was $865 billion. These figures dwarf credit card debt, which was $694 billion in the second quarter and $693 billion in the third."

"The New York Fed report is only the latest to reach a certain conclusion: Student-loan debt is reaching incredible heights. Last year, total student-loan debt passed total credit card debt for the first time."

"Mark Kantrowitz, publisher of FinAid (www.finaid.org), one of the best sites for college financial aid information, has created a Student Loan Debt Clock at www.finaid.org/loans/studentloandebtclock.phtml. The clock is an estimate of current student-loan debt outstanding, including both federal and private student loans. My last check showed more than $960 billion."

"Here’s what concerns me: All the estimates point to a disturbing milestone. If families continue the current borrowing trend, total student-loan debt will soon reach $1 trillion."

GAO Audit: At least $16 trillion in secret bank loans since 2008

"The first top-to-bottom audit of the Federal Reserve uncovered eye-popping new details about how the U.S. provided a whopping $16 trillion in secret loans to bail out American and foreign banks and businesses during the worst economic crisis since the Great Depression. An amendment by Sen. Bernie Sanders to the Wall Street reform law passed one year ago this week directed the Government Accountability Office to conduct the study. "As a result of this audit, we now know that the Federal Reserve provided more than $16 trillion in total financial assistance to some of the largest financial institutions and corporations in the United States and throughout the world," said Sanders. "This is a clear case of socialism for the rich and rugged, you're-on-your-own individualism for everyone else.""

Comedian Stewart Lee on university funding and the arts

"I think that [withdrawal of grants and the introduction of student loans] was done deliberately to rid us of all of these troublesome thinkers and artists, right? And of conscientious people.

I think if Thatcher could have done it, she would have done it."

It’s not my future at risk, it’s everybody’s by Darren Patrick

"Today I signed the pledge to refuse student debt repayments i.e. to participate in a debt strike. I have been very hesitant to sign onto this new campaign, which calls for a mass withholding of payments when 1,000,000 people have signed. It also calls for mass expressions of support from faculty and non-debtors. There are existing campaigns, such as the campaign to forgive student loan debt, which deal with many of the same issues in less radical terms. I still support the latter movements, but I also see the discourse promoted by the debt strike campaign as vital to moving beyond President Obama’s inadequate action toward a more radical agenda against long term debt slavery and austerity."

"So why did I sign the pledge and why might you sign it?

1. It focuses on the existing crisis

2. Even if the pledge does not reach 1,000,000 signatories, it creates a political space for organizing which combats the isolation, shame, and embarrassment that is often associated with being a student loan debtor. We live in a society that individualizes problems that must be addressed through collective action. This is a strategy which is meant to silence us and it must be resisted.

3. We have nothing to lose by signing the pledge and everything to gain. Signing the pledge encourages cooperation, expansion of support, and knowledge of options and alternatives. Additionally, it helps me to confront the reality that, whether or not I sign, there is a strong chance that I will be at risk of default at some point in my life.

4. Like the broader #OWS movement, the #OccupyStudentDebt movement is not a singular solution (there is no “one demand”), it is part of a radical struggle against widespread injustice in a particular form. It articulates our struggle with the struggle of people facing austerity at the hands of ‘their’ governments. It is not the ‘laziness’ of the Greek worker or the ‘complacency’ of the Italian student which is to blame for the crisis. Debt is a strategy for accumulation by the rich, whether that debt is 'sovereign' or 'student'.

We must reject the notion that profit should be individual and loss, suffering, and pain collective. We deserve more and we must fight for more. Yes, we need the efforts of more ‘moderate’ organizations and efforts to continue. This is not an either/or moment, it is both / and.

The point is to shift my consciousness and to envision the world differently. Some have already been driven to suicide because of debt. Refuse this grave injustice."

1. It focuses on the existing crisis

2. Even if the pledge does not reach 1,000,000 signatories, it creates a political space for organizing which combats the isolation, shame, and embarrassment that is often associated with being a student loan debtor. We live in a society that individualizes problems that must be addressed through collective action. This is a strategy which is meant to silence us and it must be resisted.

3. We have nothing to lose by signing the pledge and everything to gain. Signing the pledge encourages cooperation, expansion of support, and knowledge of options and alternatives. Additionally, it helps me to confront the reality that, whether or not I sign, there is a strong chance that I will be at risk of default at some point in my life.

4. Like the broader #OWS movement, the #OccupyStudentDebt movement is not a singular solution (there is no “one demand”), it is part of a radical struggle against widespread injustice in a particular form. It articulates our struggle with the struggle of people facing austerity at the hands of ‘their’ governments. It is not the ‘laziness’ of the Greek worker or the ‘complacency’ of the Italian student which is to blame for the crisis. Debt is a strategy for accumulation by the rich, whether that debt is 'sovereign' or 'student'.

We must reject the notion that profit should be individual and loss, suffering, and pain collective. We deserve more and we must fight for more. Yes, we need the efforts of more ‘moderate’ organizations and efforts to continue. This is not an either/or moment, it is both / and.

The point is to shift my consciousness and to envision the world differently. Some have already been driven to suicide because of debt. Refuse this grave injustice."

Writing on the Wall by Vijay Prashad

"One of the most difficult elements of advanced capitalism and modern society is that it is hard to identify the culprit for one's sorrows. In feudal days, there was always the baron's castle or the moneylender's office; they could be located, and the peasantry could convert their agricultural implements into weapons as they rushed to these sites. No such ease in our times.

"Abstract social domination makes it harder to point precisely to the cause of one's distress. Banks often stand in for the problem, being the front lines of financial capital – it is banks, after all, that foreclose on houses and deny credit. But the banks are only a cog in a complex system that is built upon the simple premise that only a few people are able to wield power and property for their betterment, whereas the vast mass of people have only the illusion of property and the hopes for power."

"The banks stand in for the system in general."

"Events in the U.S. are linked closely to the convulsions in the rim of southern Europe, from Greece to Spain via Italy. The root cause of the older crisis and the more recent one is the same, as pointed out by the Greek economist Yanis Varoufakis in his new book, The Global Minotaur: The True Origins of the Financial Crisis and the Future of the World Economy (2011): it has to do with the failure of the world economic system to have a surplus recycling mechanism that would redistribute accumulated surpluses across the world."

"Rather than have such a mechanism, the mandarins of the world order in the 1970s and 1980s preferred to allow vast surpluses to get sucked into the world of finance (with New York's Wall Street as its centre). This institutional failure was the cause of the new culture of greed (and not the other way around). That the political class in the Atlantic world prefers to see the solution in austerity policies against the ordinary people rather than in terms of institutional failures (let alone the system's failure) demonstrates the vacuity of its leadership. Since it offers no new political and economic project to earn the trust of the population, it must resort to the baton."

"The baton offers no solutions. The writing for the Street is on the wall."

"Abstract social domination makes it harder to point precisely to the cause of one's distress. Banks often stand in for the problem, being the front lines of financial capital – it is banks, after all, that foreclose on houses and deny credit. But the banks are only a cog in a complex system that is built upon the simple premise that only a few people are able to wield power and property for their betterment, whereas the vast mass of people have only the illusion of property and the hopes for power."

"The banks stand in for the system in general."

"Events in the U.S. are linked closely to the convulsions in the rim of southern Europe, from Greece to Spain via Italy. The root cause of the older crisis and the more recent one is the same, as pointed out by the Greek economist Yanis Varoufakis in his new book, The Global Minotaur: The True Origins of the Financial Crisis and the Future of the World Economy (2011): it has to do with the failure of the world economic system to have a surplus recycling mechanism that would redistribute accumulated surpluses across the world."

"Rather than have such a mechanism, the mandarins of the world order in the 1970s and 1980s preferred to allow vast surpluses to get sucked into the world of finance (with New York's Wall Street as its centre). This institutional failure was the cause of the new culture of greed (and not the other way around). That the political class in the Atlantic world prefers to see the solution in austerity policies against the ordinary people rather than in terms of institutional failures (let alone the system's failure) demonstrates the vacuity of its leadership. Since it offers no new political and economic project to earn the trust of the population, it must resort to the baton."

"The baton offers no solutions. The writing for the Street is on the wall."

Reuters Special Report: A "great haircut" to kick-start growth

"More than three years after the financial crisis struck, the economy remains stuck in a consumer debt trap. It's a situation that could take years to correct itself. That's why some economists are calling for a radical step: massive debt relief."

"Tens of millions of citizens remain burdened with mortgages they can no longer afford, in addition to soaring credit card bills and sky high student loans. Trillions of dollars in outstanding consumer debt is stifling demand for goods and services and that's one reason economists say cash-rich U.S. companies are reluctant to hire and unemployment remains stubbornly high."

"The notion of a Debt Jubilee dates back to biblical Israel where debts were forgiven every 50 years or so. In an August appearance on CNBC, Stephen Roach said debt forgiveness would help consumers get through "the pain of deleveraging sooner rather than later."

"But it's not just the liberal economists and doom-and-gloom financial analysts calling for a great haircut. Even some institutional investors, who might suffer some of the impact of debt reductions on their portfolios, are seeing a need for a creative solution to the mess."

"The fear of some economists is that the economy may be going into a double dip recession. That means precious time is being lost if a negotiated approach to debt reduction isn't taken now."

"Indeed, it has been two years since the notion of a "Debt Jubilee" made it into the popular culture when Trey Parker and Matt Stone used it for an episode of the politically incorrect cartoon "South Park." In the episode aired in March 2009, one of the characters used an unlimited credit card to pay off all the debts of the residents of South Park to spur the economy."

"Still, there are still plenty of economists who say the concern about consumer debt is overdone and that doing anything radical now would only make things worse. One of those is Mark Zandi, chief economist of Moody's Analytics, who says a forced write-down or haircut of debt "would only result in a much higher cost of capital going forward and result in much less credit to more risky investments."

"Tens of millions of citizens remain burdened with mortgages they can no longer afford, in addition to soaring credit card bills and sky high student loans. Trillions of dollars in outstanding consumer debt is stifling demand for goods and services and that's one reason economists say cash-rich U.S. companies are reluctant to hire and unemployment remains stubbornly high."

"The notion of a Debt Jubilee dates back to biblical Israel where debts were forgiven every 50 years or so. In an August appearance on CNBC, Stephen Roach said debt forgiveness would help consumers get through "the pain of deleveraging sooner rather than later."

"But it's not just the liberal economists and doom-and-gloom financial analysts calling for a great haircut. Even some institutional investors, who might suffer some of the impact of debt reductions on their portfolios, are seeing a need for a creative solution to the mess."

"The fear of some economists is that the economy may be going into a double dip recession. That means precious time is being lost if a negotiated approach to debt reduction isn't taken now."

"Indeed, it has been two years since the notion of a "Debt Jubilee" made it into the popular culture when Trey Parker and Matt Stone used it for an episode of the politically incorrect cartoon "South Park." In the episode aired in March 2009, one of the characters used an unlimited credit card to pay off all the debts of the residents of South Park to spur the economy."

"Still, there are still plenty of economists who say the concern about consumer debt is overdone and that doing anything radical now would only make things worse. One of those is Mark Zandi, chief economist of Moody's Analytics, who says a forced write-down or haircut of debt "would only result in a much higher cost of capital going forward and result in much less credit to more risky investments."

Paul Krugman Asked About #OWS Debt Refusal On The Brian Lehrer Show

"Lehrer then asked Krugman what he thought about that branch of the Occupy movement — that is, the group that is encouraging a million students to default on their student loans."

“To be honest, I haven’t done enough homework to figure out what I think,” Krugman replied. “I think the idea that it is a threat to the economy is wrong. It’s just not that big of deal in terms of the economy one way or another, and there is a lot that is wrong with how we handle student debt. Basically, we’ve been using public funds, but running them through the private sector for no good reason, except to provide some extra profits to the financial industry.”

“Forgive Us Our Student Loan Debt?” No Thanks! by Cryn Johannsen

"The language of loan forgiveness is archaic, and why it’s being sloughed off. Those who have promoted this must deal with the fact that we live in very different times now, and that means bolder language is necessary."

"Currently, there is an Occupy Student Debt group calling upon people to sign a pledge to refuse paying their loans. [Full disclosure: Although I am a freelance journalist, I am also an advocate for student loan debtors, and I am currently calling for a debtors' strike. Contrary to the misinformation and lies being circulated about these efforts, there are well-known authors, activists, union organizers, etc. on board with this next move. As an activist, I believe fully in collaboration and do not stick to one particular idea for personal gain. That's not how this works, especially when you are part of OWS]."

"The Washington Post piece also inaccurately pits the call for loan forgiveness against the Occupy Student Debt campaign. If read carefully, it is clear that the groups seek similar things. However, using the terms “loan forgiveness” is poor. As I have stated before, it presumes that the borrower is a sinner and they are to blame for this catastrophe. It does not illustrate the problem in an accurate way, and it is easily dismissed or denigrated. On the other hand, Occupy Student Debt is reasserting the power of borrowers, and insisting that something must be done in a more direct action way. Asking policymakers to forgive of us our sins is not needed. Did borrowers who sought higher education do anything wrong? Absolutely not. So why do they need to ask for any sort of forgiveness?"

"As Mitchel Cohen aptly pointed out:"

"Thank you for this article. There is no contradiction [my emphasis] in principle between seeking legislation that provides ‘debt forgiveness’ and organizing one million student debtors to sign a pledge that they will refuse to pay their debt. In fact, a million student refuseniks can serve as a very strong base from which to accomplish that legislation. On the other hand, putting one’s faith in Congressional reps ‘morality’ (you’re kidding, right?) alone is, I would argue, delusional."

"Do both!"

"Currently, there is an Occupy Student Debt group calling upon people to sign a pledge to refuse paying their loans. [Full disclosure: Although I am a freelance journalist, I am also an advocate for student loan debtors, and I am currently calling for a debtors' strike. Contrary to the misinformation and lies being circulated about these efforts, there are well-known authors, activists, union organizers, etc. on board with this next move. As an activist, I believe fully in collaboration and do not stick to one particular idea for personal gain. That's not how this works, especially when you are part of OWS]."

"The Washington Post piece also inaccurately pits the call for loan forgiveness against the Occupy Student Debt campaign. If read carefully, it is clear that the groups seek similar things. However, using the terms “loan forgiveness” is poor. As I have stated before, it presumes that the borrower is a sinner and they are to blame for this catastrophe. It does not illustrate the problem in an accurate way, and it is easily dismissed or denigrated. On the other hand, Occupy Student Debt is reasserting the power of borrowers, and insisting that something must be done in a more direct action way. Asking policymakers to forgive of us our sins is not needed. Did borrowers who sought higher education do anything wrong? Absolutely not. So why do they need to ask for any sort of forgiveness?"

"As Mitchel Cohen aptly pointed out:"

"Thank you for this article. There is no contradiction [my emphasis] in principle between seeking legislation that provides ‘debt forgiveness’ and organizing one million student debtors to sign a pledge that they will refuse to pay their debt. In fact, a million student refuseniks can serve as a very strong base from which to accomplish that legislation. On the other hand, putting one’s faith in Congressional reps ‘morality’ (you’re kidding, right?) alone is, I would argue, delusional."

"Do both!"

Forgive us our student loan debt by Susan Thistlewaite

"Jesus teaches his disciples to pray, “And forgive us our debts, as we forgive our debtors.” (Matthew 6:12) Forgiving debt is a moral issue. Forgiving some of the worst of this student debt is crucial literally to save this American generation."

"The American economy is also trapped in this cycle of more student borrowing and the mounting student loan debt. ‘Is this the next big credit bubble?’ asks The Economist. What happens to our fragile economy when this next house of cards comes tumbling down?"

"The #Occupy movement is part of this student debt crisis, both in terms of those who owe, and how some may choose do deal with their debt unless Congress acts responsibly."

"None of those calling for action on mounting student loan debt debates that there is a crisis. The division is over how to act: call for legislative action, or take action yourself. Those graduates I talked to on Michigan Avenue are being hurt from the huge burden of their debt, and they were despairing that their elected representatives would actually do anything to help them."

"Currently, I’m advocating debt forgiveness. It is the moral thing to do and it is the right civic thing to do. This is what Jesus actually meant; real debts, real debtors, forgiving and forgiven. This is what government is actually about—of the people, by the people, for the people. We still have a chance to show young people that democracy can work for the common good."

"The American economy is also trapped in this cycle of more student borrowing and the mounting student loan debt. ‘Is this the next big credit bubble?’ asks The Economist. What happens to our fragile economy when this next house of cards comes tumbling down?"

"The #Occupy movement is part of this student debt crisis, both in terms of those who owe, and how some may choose do deal with their debt unless Congress acts responsibly."

"None of those calling for action on mounting student loan debt debates that there is a crisis. The division is over how to act: call for legislative action, or take action yourself. Those graduates I talked to on Michigan Avenue are being hurt from the huge burden of their debt, and they were despairing that their elected representatives would actually do anything to help them."

"Currently, I’m advocating debt forgiveness. It is the moral thing to do and it is the right civic thing to do. This is what Jesus actually meant; real debts, real debtors, forgiving and forgiven. This is what government is actually about—of the people, by the people, for the people. We still have a chance to show young people that democracy can work for the common good."

The New Yorker: Why Nobody Sh*ts In Jail by Keith Gessen

“But there simply cannot be any rule, or any carceral logic, or any arguments whatsoever, for filthy toilets. And sitting there, with the stench from our filthy toilet filling the room, and with the filth in our filthy sink making me less eager than I ought to have been to drink from it, despite being thirsty, I became angry—really, honestly, for the first time. I thought for the first time, with genuine venom, of the hypocrite mayor Michael Bloomberg, a billionaire, who shut down the Occupy Wall Street encampment for reasons of “health and safety” but has not deemed it worthwhile to make sure that the toilets in facilities that he has control of meet even the most minimal standards of health and safety, such that, while I watched, about forty men, eating a total of a hundred meals, over the course of a day and a half, refused to perform a single bowel movement. This was its own form of civil disobedience, I suppose, and if I’d had my wits about me maybe I could have organized a meeting of all the inmates at Bloomberg’s residence, on East Seventy-ninth Street, so that we could all take a giant shit on his front stoop."

"As Elijah made to leave, an officer approached him. An argument ensued. It ended with the officer tackling Elijah onto the group of people sitting behind him. A number of other officers jumped in. Seconds later, Elijah was pulled up to his feet, away from the group, looking dazed, his shirt ripped. This was ugly. The officer who tackled Elijah was an athlete, you could see it in his neck and shoulders, and a grown man; Elijah is a skinny kid. It was also the case that Elijah was one of the few black people at our protest that day; the officer was white."

"Here is another statistic: Over the course of the thirty-two hours we were held at the Tombs, about twenty-five non-protesters cycled through our cell. In any case, out of those twenty-five inmates on their way to hearings, just one was white. One was Asian. A few—maybe three or four—were Hispanic. The rest were black. Is it really possible that non-whites commit ninety-six per cent of all crimes in Manhattan? I don’t know. Perhaps, outside of Wall Street, whites are just very law-abiding. And most of the crimes appeared to be drug-related—perhaps white people don’t do drugs."

Occupy Student Debt: Students Urged to Refuse to Pay Off Loans As Schools Hike Tuition

"Democracy Now speaks with two guests who helped launch the "Occupy Student Debt Campaign" Pledge of Refusal, which asks student signatories to refuse their student loan debt until a number of education reforms are implemented, including free public education. Pamela Brown is a Ph.D student in Sociology at The New School, and Andrew Ross is a professor of social and cultural analysis at New York University."

Meet 5 Big Lenders Profiting From the $1 Trillion Student Debt Bubble

So just who are the lenders profiting from the massive student debt load?

You already know some of the names: JP Morgan Chase, U.S Bank, Citi, Bank of America. Others are non-bank student lenders. What all of them have in common, though, is that their practices are shrouded in secrecy. A recent release from the Consumer Financial Protection Bureau, the brainchild of now-Senate candidate Elizabeth Warren, called for an investigation into the industry:

"It has been operating in the shadows for too long," Raj Date, the Treasury Department adviser who is running the Consumer Financial Protection Bureau, said in a release. "Shedding light on this industry will benefit students, lenders, and the market as a whole."

Here, we take a look at five of the lenders raking in the cash off the backs of the U.S.'s students.

I Too Am a Debt-Peon by Justin Smith

"I don’t know if it will burst or not, or whether there will be a massive revolt of debt-peons in the coming years. One thing that has shifted in me over the course of the past few months, though –clearly as a result of the Occupy movement and some of the arguments coming out of it (I wish I could say I’m lucid enough to grasp these arguments on my own, but the truth is that it required a major historical shift for me to get a clue)–, one thing that has shifted is that I regard this whole racket as being a good deal less legitimate than I used to. They’re going to squeeze as much as they can out of me, and I’m going to resist as much as I can."

"... I am finally starting to appreciate the force of the ‘Education Is a Right’ slogan, a slogan that used to seem questionable to me (to the extent that rights-talk in general seemed questionable); it now seems to me that I was simply availing myself of that right in 1994, and the expectation that I should spend the bulk of my life paying for this seems at least disproportionate. Moreover, it has come to seem to me that usurious interest on a loan, while advantageous to the creditor, frees the debtor up of any need to think about the debt in moral terms. They’re doing something sleazy, trying to squeeze out what they can; I’ll go ahead and be wily in response, and try to hold onto what I can."

"... I am finally starting to appreciate the force of the ‘Education Is a Right’ slogan, a slogan that used to seem questionable to me (to the extent that rights-talk in general seemed questionable); it now seems to me that I was simply availing myself of that right in 1994, and the expectation that I should spend the bulk of my life paying for this seems at least disproportionate. Moreover, it has come to seem to me that usurious interest on a loan, while advantageous to the creditor, frees the debtor up of any need to think about the debt in moral terms. They’re doing something sleazy, trying to squeeze out what they can; I’ll go ahead and be wily in response, and try to hold onto what I can."

Student Loan Fury in the Occupy Movement by Brian McKenna

"It’s not just a question for students studying “the

science of man.” In 1960 relatively few graduates had student loans to

speak of. Today over 70 million Americans have them. The total U.S.

student loan debt will exceed a trillion dollars for the first time this

year, going beyond credit card debt, according to USA Today

(2011). Banks engage in the same kinds of predatory lending with

students as they performed with desperate mortgage seekers when they

dispensed liar’s loans with great zeal. That helped trigger the

Financial Meltdown of 2008. As is now well known, the state bailed out

the banks but abandoned the debtors. Overwhelmed, tens of thousands have

taken to the streets in the Occupation Movement. It’s a kind of festival of public pedagogy where youth are performing the educational

work that academics have long ignored."

"As Robert Lawless puts it, "The last thing the current ruling class wants is a group of people trained to think critically, i.e., question the structure and conventions propagated by the ruling classes. . . .what the ruling class wants are technicians.""

"Universities were once viewed as laboratories for free inquiry and debate. Today they are under siege from privatizers, ideologues, anxious college administrators. . .and the banks."

"It’s time to return universities to faculty. And it’s time to provide our youth with a fresh start in life, unburdened by debt peonage to Wall Street."

"As Robert Lawless puts it, "The last thing the current ruling class wants is a group of people trained to think critically, i.e., question the structure and conventions propagated by the ruling classes. . . .what the ruling class wants are technicians.""

"Universities were once viewed as laboratories for free inquiry and debate. Today they are under siege from privatizers, ideologues, anxious college administrators. . .and the banks."

"It’s time to return universities to faculty. And it’s time to provide our youth with a fresh start in life, unburdened by debt peonage to Wall Street."

Mother Jones: Student Occupiers, It's the Debt, Stupid

"More stats on the dire financial straits of America's college students:"

"Unemployment among college grads is twice what it was in 2007. According to the Economic Policy Institute, the unemployment rate for 16-24-year-olds is twice the national average; grads under 25 are twice as likely to lack a job than their older peers. The New York Times reports that just half of students who graduated in 2010 had a job in the spring of 2011, and even those who did get jobs were often way overqualified."

"Unemployment among college grads is twice what it was in 2007. According to the Economic Policy Institute, the unemployment rate for 16-24-year-olds is twice the national average; grads under 25 are twice as likely to lack a job than their older peers. The New York Times reports that just half of students who graduated in 2010 had a job in the spring of 2011, and even those who did get jobs were often way overqualified."

The Hill: College debt threatens the hopes and dreams of minority students

"Our country is facing a perfect storm of rising college costs, student debt and growing inequality. While the costs will be

significant for an entire generation of students, they will be

particularly high for Black and Hispanic graduates struggling to create a

more prosperous future."

"The odds of paying off college debt are much tougher for minority graduates, particularly Black men, who face far higher unemployment than their White counterparts. More than 25 percent of Black men younger than 24 with college degrees were unemployed last year, about the same rate as young Black men who were college dropouts."

"Black and Hispanic students also graduate with higher debt, including more than half who graduate with unmanageable debt. Black college graduates are nearly twice as likely as Whites to owe $30,500 or more, according to the College Board."

"The college debt anchor has become a key contributor to the growing racial wealth gap, perpetuating inequalities across generations. A Pew Research Center report released this summer showed that the gap between white households and African American and Latino households is greater than it’s ever been, with the median wealth of white households 20 times that of African American and 18 times that of Latino families."

"Weighed down by the college debt anchor, minority students will graduate at a severe wealth disadvantage, taking years to pay off loans before they can begin to save for a home or for retirement."

"The odds of paying off college debt are much tougher for minority graduates, particularly Black men, who face far higher unemployment than their White counterparts. More than 25 percent of Black men younger than 24 with college degrees were unemployed last year, about the same rate as young Black men who were college dropouts."

"Black and Hispanic students also graduate with higher debt, including more than half who graduate with unmanageable debt. Black college graduates are nearly twice as likely as Whites to owe $30,500 or more, according to the College Board."

"The college debt anchor has become a key contributor to the growing racial wealth gap, perpetuating inequalities across generations. A Pew Research Center report released this summer showed that the gap between white households and African American and Latino households is greater than it’s ever been, with the median wealth of white households 20 times that of African American and 18 times that of Latino families."

"Weighed down by the college debt anchor, minority students will graduate at a severe wealth disadvantage, taking years to pay off loans before they can begin to save for a home or for retirement."

Sex, Class, and Occupy Wall Street from "Sasha Said"

"As for the much-discussed demographics of the Occupy movement, it

shouldn’t surprise anyone that white dudes with middle class upbringings

are disproportionately represented among the “full-time” occupiers.

With the exception of those currently unemployed, the working poor are

typically too busy working two or three jobs to keep a roof over their

head to occupy stuff. If we don’t show up for work, we don’t get paid,

and if we don’t get paid, we can’t make the rent. The Occupy movement doesn’t just protest the economic realities in this country, it also reflects them."

"Women are not only more likely to be poor and underpaid (roughly two-thirds of all minimum wage workers are women), but with all the unpaid domestic work and care-taking we are saddled with, we’re going to have far less time to join protests. On top of that, the ever-present threat of rape serves as a powerful deterrent against overnight stays in tents surrounded by dudes."

"It’s absolutely critical that the white male protesters who are in the majority at every “occupation” understand *why* they outnumber female activists. I’ve seen some pretty disturbing statements from dudes who clearly don’t. Suggesting that those present 24/7 at Occupied sites are more committed to the movement’s goals than those who are able to stay only a short time demonstrates a stunning lack of awareness of male, white, ableist, and class privilege."

"Being poor in the US of A is not just about not being able to “buy stuff.” Being poor frequently means going to bed hungry. It means watching your partner collapse after a day of hard physical labor in 100+ degree heat for which he was paid $5 an hour. It means walking home seven miles in icy cold wind and rain because you can’t afford a car and public transportation is extremely limited. It means cops automatically regarding you with suspicion, and courts locking you up for minor offenses. Most of all, being poor in the US means suffering, and possibly dying, because you can’t afford medical, dental, or psychiatric care–and being forced to stand by helplessly as your friends and loved ones suffer."

"For women, being poor also means that you are more likely to be raped and less likely to see your rapist brought to justice. It means you are more likely to be sexually harassed on the street and at work, and less likely to have recourse against employment-based harassment and exploitation because you really need that job. It means you’re more likely to become a victim of domestic violence and less likely to be able to escape because you’re not paid enough to live alone. And yes, being a poor woman also means that you’re more likely to turn to prostitution or other sex work–either as a “career choice” because that’s the one form of employment open to you that pays enough to possibly escape poverty, or as something you do occasionally to make ends meet."

"Get involved in the Occupy movement and point out how unbridled capitalism, environmental destruction, and patriarchy are inextricably linked? I’m all for it. But not support the movement at all? I don’t have that luxury. I need this movement to succeed. And, really, so do you."

"Women are not only more likely to be poor and underpaid (roughly two-thirds of all minimum wage workers are women), but with all the unpaid domestic work and care-taking we are saddled with, we’re going to have far less time to join protests. On top of that, the ever-present threat of rape serves as a powerful deterrent against overnight stays in tents surrounded by dudes."

"It’s absolutely critical that the white male protesters who are in the majority at every “occupation” understand *why* they outnumber female activists. I’ve seen some pretty disturbing statements from dudes who clearly don’t. Suggesting that those present 24/7 at Occupied sites are more committed to the movement’s goals than those who are able to stay only a short time demonstrates a stunning lack of awareness of male, white, ableist, and class privilege."

"Being poor in the US of A is not just about not being able to “buy stuff.” Being poor frequently means going to bed hungry. It means watching your partner collapse after a day of hard physical labor in 100+ degree heat for which he was paid $5 an hour. It means walking home seven miles in icy cold wind and rain because you can’t afford a car and public transportation is extremely limited. It means cops automatically regarding you with suspicion, and courts locking you up for minor offenses. Most of all, being poor in the US means suffering, and possibly dying, because you can’t afford medical, dental, or psychiatric care–and being forced to stand by helplessly as your friends and loved ones suffer."

"For women, being poor also means that you are more likely to be raped and less likely to see your rapist brought to justice. It means you are more likely to be sexually harassed on the street and at work, and less likely to have recourse against employment-based harassment and exploitation because you really need that job. It means you’re more likely to become a victim of domestic violence and less likely to be able to escape because you’re not paid enough to live alone. And yes, being a poor woman also means that you’re more likely to turn to prostitution or other sex work–either as a “career choice” because that’s the one form of employment open to you that pays enough to possibly escape poverty, or as something you do occasionally to make ends meet."

"Get involved in the Occupy movement and point out how unbridled capitalism, environmental destruction, and patriarchy are inextricably linked? I’m all for it. But not support the movement at all? I don’t have that luxury. I need this movement to succeed. And, really, so do you."

Review of DEFAULT: The Student Loan Documentary

"DEFAULT, over the course of its half-hour running time, charts

the the broken careers, relationships, and lives that crippling student

loan debt leaves in its wake. For those unfamiliar with the true scope of this crisis, DEFAULT

is a great introduction that interweaves facts and statistics with the

very human costs involved, told through at times gut-wrenching personal

stories."

"However, this film stumbles a bit in terms of its analysis — and downright falls over in terms of its call to action. For example, a key question overlooked (and one that might have pointed to more interesting action possibilities) is "why is tuition rising so fast?"

"... I would've enjoyed a bigger picture analysis, politically and economically. Debt has long been understood as a mechanism of control to wield against the poor and working class, and speculation bubbles are an inevitable expression of finance capitalism's drive for capital accumulation and balance sheet growth."

"The action points suggested are very rudimentary, and not seriously considered or studied."

"And then President Obama is shown at the very end, speaking at a State of the Union address about affordable college and the most incremental of student loan reforms. That snippet is an all too-fitting symbol of the disastrous results of relying on the standard liberal model of social change."

"However, this film stumbles a bit in terms of its analysis — and downright falls over in terms of its call to action. For example, a key question overlooked (and one that might have pointed to more interesting action possibilities) is "why is tuition rising so fast?"

"... I would've enjoyed a bigger picture analysis, politically and economically. Debt has long been understood as a mechanism of control to wield against the poor and working class, and speculation bubbles are an inevitable expression of finance capitalism's drive for capital accumulation and balance sheet growth."

"The action points suggested are very rudimentary, and not seriously considered or studied."

"And then President Obama is shown at the very end, speaking at a State of the Union address about affordable college and the most incremental of student loan reforms. That snippet is an all too-fitting symbol of the disastrous results of relying on the standard liberal model of social change."

Five Theses on Privatization and the UC Struggle by Nathan Brown

THESES

1. Tuition increases are the problem, not the solution.

"What is happening as tuition increases is that money is being shifted out of instructional budgets and into private credit markets, as collateral for university investments."

2. Police brutality is an administrative tool to enforce tuition increases.

"Police brutality against students, workers, and faculty is not an accident—just like it has not been an accident for decades in black and brown communities. Like privatization, and as an essential part of privatization, police brutality is a program, an implicit policy. It is a method used by UC administrators to discipline students into paying more, to beat them into taking on more debt, to crush dissent and to suppress free speech. Police brutality is the essence of the administrative logic of privatization."

3. What we are struggling against is not the California legislature, but the upper administration of the UC system.

"This struggle against the administration is not about attacking individuals—or not primarily. It is about the administrative logic of privatization, and the manner in which that logic is enforced. It is the job of the upper administration to push through tuition increases by deferring, displacing, and, if necessary, brutally repressing dissent. The program of privatization depends upon this."

4. The university is the real world.

"Two years ago, positioning the university as an anti-capitalist struggle was seen as divisive. The argument was that such a position was alienating and that it would inhibit mass participation. But now we see that there is a mass, national movement which is explicitly anti-capitalist, which positions itself explicitly as a class struggle, and, in doing so, struggles against debt and austerity as the interlinking financial logics of a collapsing American economy. Given this context: the only way the university struggle can isolate itself is by failing or refusing to acknowledge that it is also an anti-capitalist struggle, that it is also a class struggle."

“We are all debtors,” said a student at Berkeley as she called for this strike. That is a powerful basis of solidarity.

5. We are winning.

"The occupation of university buildings is a time-honored tactic in student struggles. But by many it was also viewed as a “divisive” or “vanguardist” tactic two years ago. Now, thanks largely to the example of the Egyptian revolution, the occupation of public space has become the primary tactic in a national protest movement supported by some 60% of the American people. The mass adoption of this tactic, the manner in which it has grown beyond the university struggle, is a huge victory for our movement."

"The resonance of university occupations with the national occupation movement means that our struggle is growing and expanding. That means we are winning. And the fact that the university struggle can no longer plausibly be considered in isolation from from anti-capitalist struggle broadly conceived is itself a huge victory."

1. Tuition increases are the problem, not the solution.

"What is happening as tuition increases is that money is being shifted out of instructional budgets and into private credit markets, as collateral for university investments."

2. Police brutality is an administrative tool to enforce tuition increases.

"Police brutality against students, workers, and faculty is not an accident—just like it has not been an accident for decades in black and brown communities. Like privatization, and as an essential part of privatization, police brutality is a program, an implicit policy. It is a method used by UC administrators to discipline students into paying more, to beat them into taking on more debt, to crush dissent and to suppress free speech. Police brutality is the essence of the administrative logic of privatization."

3. What we are struggling against is not the California legislature, but the upper administration of the UC system.

"This struggle against the administration is not about attacking individuals—or not primarily. It is about the administrative logic of privatization, and the manner in which that logic is enforced. It is the job of the upper administration to push through tuition increases by deferring, displacing, and, if necessary, brutally repressing dissent. The program of privatization depends upon this."

4. The university is the real world.

"Two years ago, positioning the university as an anti-capitalist struggle was seen as divisive. The argument was that such a position was alienating and that it would inhibit mass participation. But now we see that there is a mass, national movement which is explicitly anti-capitalist, which positions itself explicitly as a class struggle, and, in doing so, struggles against debt and austerity as the interlinking financial logics of a collapsing American economy. Given this context: the only way the university struggle can isolate itself is by failing or refusing to acknowledge that it is also an anti-capitalist struggle, that it is also a class struggle."

“We are all debtors,” said a student at Berkeley as she called for this strike. That is a powerful basis of solidarity.

5. We are winning.

"The occupation of university buildings is a time-honored tactic in student struggles. But by many it was also viewed as a “divisive” or “vanguardist” tactic two years ago. Now, thanks largely to the example of the Egyptian revolution, the occupation of public space has become the primary tactic in a national protest movement supported by some 60% of the American people. The mass adoption of this tactic, the manner in which it has grown beyond the university struggle, is a huge victory for our movement."

"The resonance of university occupations with the national occupation movement means that our struggle is growing and expanding. That means we are winning. And the fact that the university struggle can no longer plausibly be considered in isolation from from anti-capitalist struggle broadly conceived is itself a huge victory."

George Orwell, Imperialism, and Police Brutality

"Why did police use baton strikes and pepper spray against nonviolent protesters on University of California campuses? ... authority figures [want] to avoid derisive laughter."

"read "Shooting an Elephant," George Orwell's reflection on his time as a British imperial police officer in Burma."

"In Burma, Orwell remembers, every British police officer was a target of constant ridicule":

"But once they're out there -- people all around, photographs being snapped, video cameras rolling -- it's the cops who feel powerless. The kids won't listen. Nobody wants to be the one to say, "Um, should we retreat?" Had they left, the crowd would've burst into cheers at their expense. No one wants to make the first move either. Some of them seethe. Others feel embarrassed, like the macho high school wrestler forced to square off against a girl in practice. If he goes too hard he'll feel bad. If he goes too easy and loses he'll be humiliated and ridiculed."

"read "Shooting an Elephant," George Orwell's reflection on his time as a British imperial police officer in Burma."

"In Burma, Orwell remembers, every British police officer was a target of constant ridicule":

"All I knew was that I was stuck between my hatred of the empire I served and my rage against the evil-spirited little beasts who tried to make my job impossible. With one part of my mind I thought of the British Raj as an unbreakable tyranny, as something clamped down, in saecula saeculorum, upon the will of prostrate peoples; with another part I thought that the greatest joy in the world would be to drive a bayonet into a Buddhist priest's guts. Feelings like these are the normal by-products of imperialism; ask any Anglo-Indian official, if you can catch him off duty."

"when the white man turns tyrant, it is his own freedom that he destroys. He becomes a sort of hollow, posing dummy, the conventionalized figure of a sahib. A sahib has got to act like a sahib; he has got to appear resolute, to know his own mind and do definite things. To come all that way, rifle in hand, with two thousand people marching at my heels, and then to trail feebly away, having done nothing - no, that was impossible. The crowd would laugh at me. And my whole life, every white man's life in the East, was one long struggle not to be laughed at.""The U.C. police officers are dressed in riot gear. They're given guns, batons, body armor, face shields, and spray canisters of pepper spray. And they're sent out in force."

"But once they're out there -- people all around, photographs being snapped, video cameras rolling -- it's the cops who feel powerless. The kids won't listen. Nobody wants to be the one to say, "Um, should we retreat?" Had they left, the crowd would've burst into cheers at their expense. No one wants to make the first move either. Some of them seethe. Others feel embarrassed, like the macho high school wrestler forced to square off against a girl in practice. If he goes too hard he'll feel bad. If he goes too easy and loses he'll be humiliated and ridiculed."

How economic inequality harms societies

"Richard Wilkinson charts the hard data on economic inequality, and shows what gets worse when rich and poor are too far apart:

real effects on health, lifespan, even such basic values as trust."

real effects on health, lifespan, even such basic values as trust."

"(~8:45 min.): If Americans want to live the 'American Dream',

they should go to Denmark."

Surveillance Self-Defense

"The Electronic Frontier Foundation (EFF) has created this Surveillance Self-Defense site to educate the American public about the law and technology of government surveillance in the United States, providing the information and tools necessary to evaluate the threat of surveillance and take appropriate steps to defend against it."

"Surveillance Self-Defense (SSD) exists to answer two main questions: What can the government legally do to spy on your computer data and communications? And what can you legally do to protect yourself against such spying?"

WSJ: The Surveillance Catalog - Where governments get their tools

"Documents obtained by The Wall Street Journal open a rare window into a new global market for the off-the-shelf surveillance technology that has arisen in the decade since the terrorist attacks of Sept. 11, 2001."

"The techniques described in the trove of 200-plus marketing documents include hacking tools that enable governments to break into people’s computers and cellphones, and "massive intercept" gear that can gather all Internet communications in a country."

"The documents—the highlights of which are cataloged and searchable here—were obtained from attendees of a secretive surveillance conference held near Washington, D.C., last month."

"The techniques described in the trove of 200-plus marketing documents include hacking tools that enable governments to break into people’s computers and cellphones, and "massive intercept" gear that can gather all Internet communications in a country."

"The documents—the highlights of which are cataloged and searchable here—were obtained from attendees of a secretive surveillance conference held near Washington, D.C., last month."

Top 10 Tips for Filming #Occupy Protests, Arrests & Police Conduct

PREPARE: Know your equipment. Turn off features to maximize battery life (e.g. wifi search on phones). Have charged and extra batteries, use empty memory cards and bring back-ups. Use a camera strap or tie your camera to your wrist. Where possible, turn-on correct date, time and location capturing features. Write the National Lawyer’s Guild’s phone number (or other legal support team) on your forearm and save in case you need legal support. (In NYC: 212.679.6018) If arrests occur, call in location, time and name of anyone arrested.

FILM WITH INTENTION: Hold your shot steady (minimum 10 seconds), pan VERY slowly, avoid jerky movements and zooming – move closer when possible. Get multiple angles – wide, medium and close-up. Film for those who aren’t there – what do they need to see to understand what’s going on? If violence or abuse occurs – KEEP RECORDING.ALWAYS CAPTURE: Date, time and location (intersections, street signs, landmarks.) Get various angles when documenting the size/behavior of the crowd, number and formation of police and any weapons they are holding or using. Record any police orders or permissions given and the time and officer’s name and badge number. Record when police are creating or moving barricades or orange nets. Record any police filming protests or protesters.

CAPTURE DETAILS – INCIDENTS: If there is an arrest or violence, attempt to capture the entire incident, including: time, location, number and identities of involved individuals, and broader crowd or police presence/behavior. Film or say names of officers, badge numbers or helmet number into the camera. Work to get faces of those affected on film. Be agile: Film from above if possible, or low through officers’ legs to capture what’s happening. Consider verbally adding noteworthy facts of what was happening before you started filming to give context while you film.

WORK AS A TEAM: If filming, have a partner to watch your back, help keep you safe and alert you of other potential shots you should capture. If more than one of you is filming, try to get separate angles of the same incident – ideally keep each other in view. If you are at risk of arrest and want to keep filming, consider giving media card to friend for safe keeping and replace with empty card and KEEP RECORDING.

TITLE WITH INTENTION: Keep titles brief and descriptive. Add date, location and time. Use words you or one would use to find your video. E.g. Occupy, New York City, Protest

DESCRIBE YOUR VIDEO: Always include date, location and details of what happened BEFORE, DURING and AFTER recording. Consider starting with a URL for viewers to find more info, e.g. http://www.occupywallst.org – November 12, 2011 | Brooklyn, NY | then video description.

TAG YOUR VIDEO: Always add these tags -> date, time, city, specific location, occupy wall street, occupy, ows. Use common tags found in your search: ‘police brutality’ ‘arrest’ ‘pepper spray’

SAFETY or SECURITY CONCERNS? If you think faces need to be blurred or feel the video may harm someone’s case or dignity, think twice before uploading. Contact the volunteer legal team for advice.

SAVE AND NAME YOUR VIDEO: Do not rely on YouTube or other sites to save and preserve your footage – it may be taken down and valuable technical information is lost in the upload. Save original footage to your computer and back up to an external hard drive. Name files and organize so they are easy to find – add date, location and tags.

Undergraduate Student Loan Debt by Race

"2/3 of students graduate with debt, at an average of $24,842. African Americans are most likely to borrow and graduate with more debt."

UC Davis Pepper Spray Incident

"Students. Sitting down. With bowed heads. On university property. Police freely moving around them, pepper spraying them, facing no resistance whatsoever. Just students. Sitting on the ground."

"Police used batons to try to push the students apart. Those they could separate, they arrested, kneeling on their bodies and pushing their heads into the ground. Those they could not separate, they pepper-sprayed directly in the face, holding these students as they did so. When students covered their eyes with their clothing, police forced open their mouths and pepper-sprayed down their throats. Several of these students were hospitalized. Others are seriously injured. One of them, forty-five minutes after being pepper-sprayed down his throat, was still coughing up blood."

"Lt. Pike has received a salary in excess of $100,000 from the people of California each of the last three years. More than 40% of his 2010 salary came from student fees."

Emergency Petition to End the Repression of UC Students!

Honest Chung: Student Debt is a Form of Violence

"When they raise our fees, they raise their profits!"

RT: Debt and Buried, US Students slaves to their loans

“Right now, I can’t even get a job cleaning toilets for minimum wage. I’ve tried a local motel, there’s nothing,” she told RT. “I'm just begging for any sort of work. Walking around, applying to Starbucks, McDonald’s, like I did when I was 17. And it makes me think: ‘Wow, why did I even go to college if this is what it's ending up with?’”

AP / MSNBC: US wealth gap between young and old is widest ever

"The analysis by the Pew Research Center reflects the impact of the economic downturn, which has hit young adults particularly hard. More are pursuing college or advanced degrees, taking on debt as they wait for the job market to recover ... The report, coming out before the Nov. 23 deadline for a special congressional committee to propose $1.2 trillion in budget cuts over 10 years, casts a spotlight on a government safety net that has buoyed older Americans on Social Security and Medicare amid wider cuts to education and other programs. Complaints about wealth inequality, high unemployment and student debt also have been front and center at Occupy Wall Street protests around the country."

"Households headed by someone under age 35 had their median net worth reduced by 27 percent in 2009 as a result of unsecured liabilities, mostly a combination of credit card debt and student loans. No other age group had anywhere near that level of unsecured liability acting as a drag on net worth; the next closest was the 35-44 age group, at 10 percent."

"Households headed by someone under age 35 had their median net worth reduced by 27 percent in 2009 as a result of unsecured liabilities, mostly a combination of credit card debt and student loans. No other age group had anywhere near that level of unsecured liability acting as a drag on net worth; the next closest was the 35-44 age group, at 10 percent."

‘Anti-Dowry’?: The Effects of Student Loan Debt on Marriage and Childbearing

A study by religious conservatives fears the effects of student loan debt on families:

"Beyond theory, what statistics exist regarding the relation of student debt to family formation?"

"The traditional transition from adolescence to adulthood has been marked by finding a full-time job, leaving one’s childhood home, marrying, purchasing a new home, and having children. Increasingly, “the achievement of many of these markers is being delayed, or indeed, not reached at all,” with student loan debt a significant cause."

"There is also some new evidence suggesting that student loan debt encourages cohabitation at the expense of marriage."

• Overall, “Debt brought into marriage” was, out of the list of 42, the third most problematic issue facing all newlyweds.

• Among respondents who had no children, “Debt brought into marriage” was the second greatest problem.

• For respondents ages 29 and below, “Debt brought into marriage” was rated first; i.e., as the most problematic issue they faced.

• Respondents married one year or less also reported “Debt brought into marriage” as their most serious problem.

"Beyond theory, what statistics exist regarding the relation of student debt to family formation?"

"The traditional transition from adolescence to adulthood has been marked by finding a full-time job, leaving one’s childhood home, marrying, purchasing a new home, and having children. Increasingly, “the achievement of many of these markers is being delayed, or indeed, not reached at all,” with student loan debt a significant cause."

"There is also some new evidence suggesting that student loan debt encourages cohabitation at the expense of marriage."

• Overall, “Debt brought into marriage” was, out of the list of 42, the third most problematic issue facing all newlyweds.

• Among respondents who had no children, “Debt brought into marriage” was the second greatest problem.

• For respondents ages 29 and below, “Debt brought into marriage” was rated first; i.e., as the most problematic issue they faced.

• Respondents married one year or less also reported “Debt brought into marriage” as their most serious problem.

Female students pay off debts by dating 'sugar daddies'

"Saddled with piles of student debt and a job-scarce, lackluster economy, current college students and recent graduates are selling themselves to pursue a diploma or pay down their loans. An increasing number, according to the owners of websites that broker such hook-ups, have taken to the web in search of online suitors or wealthy benefactors who, in exchange for sex, companionship, or both, might help with the bills."

"Rich guys well past their prime have been plunking down money for thousands of years in search of a tryst or something more with women half their age -- and women, willingly or not, have made themselves available. With the whole process going digital, women passing through a system of higher education that fosters indebtedness are using the anonymity of the web to sell their wares and pay down their college loans."

"Most of these young women have debt from school," says Jack, who finds most young women also carry an average of $8,000 in credit-card debt. "I guess I like the college girls more because I think of their student debt as good debt. At least it seems like I'm helping them out, like I'm helping them to get a better life."

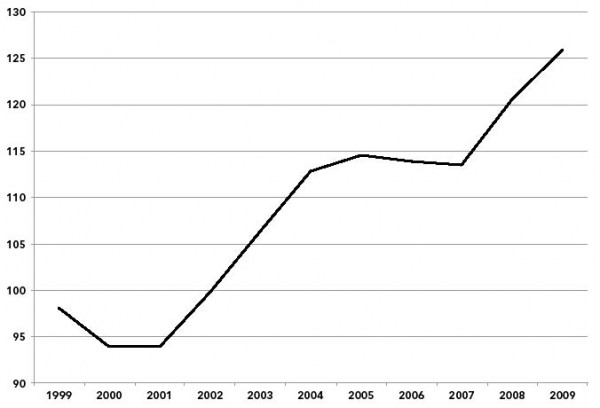

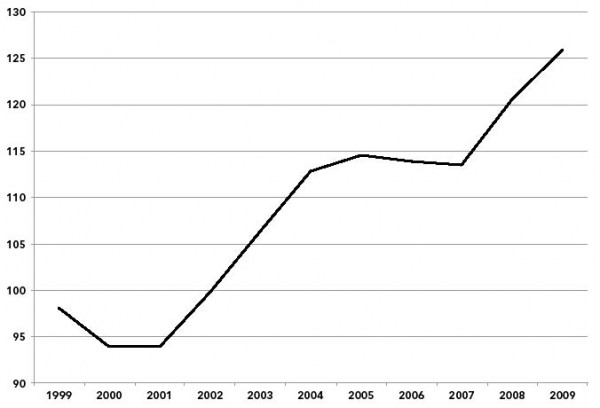

The Atlantic: Student Loans Have Grown 511% Since 1999

"How does the housing bubble debt compare? The growth of student loans has been twice as steep -- and it's showing no signs of slowing."

"All this college debt could put the U.S. on a slower growth path in the years to come. As Americans grapple with high student loan payments for the first few decades of their adult lives, they'll have less money to spend and invest. All that money flowing into colleges and universities is being funneled away from other industries where it would have been spent in future years."

Forbes: The Costliest Bubble

The views of a libertarian businessmen with an elite education:

"While the bursting of the housing bubble has dealt the US economy a body blow, there may in fact be an economic bubble with far more substantial consequences to our prosperity: the college education bubble."

"The more important cost will be from decades of mis-allocation of resources that likely is already costing our economy trillions in lost growth and productivity. I will tell you something almost every business owner knows: We business owners may whine from time to time that banks won’t lend us money, but what really is in short support are great people. Nothing has more long-term impact on an economy than amount and types of skills that are sought by future workers. That is why everyone accepts as a truism that education is critical to economic health."

"Yes, we will have to bail out some student loans, and it will likely cost us tens of billions of dollars. But that cost will be trivial compared to the toll that thirty years of mis-directed education will take on the economy. Many folks on both sides of the political aisle are lamenting a stagnation in wages and productivity — can there be any doubt that there is a connection to our mis-allocation of education investment?"

"While the bursting of the housing bubble has dealt the US economy a body blow, there may in fact be an economic bubble with far more substantial consequences to our prosperity: the college education bubble."

"The more important cost will be from decades of mis-allocation of resources that likely is already costing our economy trillions in lost growth and productivity. I will tell you something almost every business owner knows: We business owners may whine from time to time that banks won’t lend us money, but what really is in short support are great people. Nothing has more long-term impact on an economy than amount and types of skills that are sought by future workers. That is why everyone accepts as a truism that education is critical to economic health."

"Yes, we will have to bail out some student loans, and it will likely cost us tens of billions of dollars. But that cost will be trivial compared to the toll that thirty years of mis-directed education will take on the economy. Many folks on both sides of the political aisle are lamenting a stagnation in wages and productivity — can there be any doubt that there is a connection to our mis-allocation of education investment?"

Enacting the Impossible (On Consensus Decision Making) by David Graeber

"The direct democratic process adopted by Occupy Wall Street has deep roots in American radical history. It was widely employed in the civil rights movement and by the Students for a Democratic Society. But its current form has developed from within movements like feminism and even spiritual traditions (both Quaker and Native American) as much as from within anarchism itself. The reason direct, consensus-based democracy has been so firmly embraced by and identified with anarchism is because it embodies what is perhaps anarchism’s most fundamental principle: that in the same way human beings treated like children will tend to act like children, the way to encourage human beings to act like mature and responsible adults is to treat them as if they already are."

"We may never be able to prove, through logic, that direct democracy, freedom and a society based on principles of human solidarity are possible. We can only demonstrate it through action. In parks and squares across America, people have begun to witness it as they have started to participate. Americans grow up being taught that freedom and democracy are our ultimate values, and that our love of freedom and democracy is what defines us as a people—even as, in subtle but constant ways, we’re taught that genuine freedom and democracy can never truly exist. The moment we realize the fallacy of this teaching, we begin to ask: how many other “impossible” things might we pull off? And it is there, it is here, that we begin enacting the impossible."

Thank Obama for the Occupy Wall Street Movement by Glen Ford

"The power of the movement derives from the inexorable logic of its animating slogans. It is, at root, opposed to the rule of finance capital – although even the word “capital” is repugnant to some participants who believe themselves to be engaged in a spiritual quest far beyond the parameters of political economy. Nevertheless it is a fact that opposition to the rule of finance capital – to Wall Street – is opposition to capitalism as it actually exists in the here and now. Judging by the ballooning of the movement and the demeanor of its troops, opposition to capitalism as it actually exists turns out to be an exquisitely exhilarating and fulfilling activity, whether those so engaged consider themselves socialists or not."

"The brilliance – if not genius – of the movement, is in the evocation of “occupation” when coupled with the address of the enemy, Wall Street. To many of the participants, “Occupy Wall Street” signifies the elevation of human needs and values over Wall Street profits – a laudable, though amorphous, goal. But to “occupy” the enemy’s camp is to grapple with him for physical and/or political space. Inevitably, that means a struggle whose outcome can only be measured in terms of power. In this arena, left-liberal nostrums of tinkering and accommodation with fundamental evils must fail – and will be seen as inadequate to the struggle, early on."

"The cumbersome horizontal mechanisms of the Occupy movement are, in practice, a prophylactic against co-optation by the Democratic Party – a greater danger than the police. To put it bluntly, OWS practice makes it difficult for the movement to make a “deal” with Wall Street’s minions in the Democratic Party and like-minded circles, even if the weaker reformers in the ranks wanted to – which many do, judging by some of the proposals swirling around the milieu."

"The mostly white OWS movement had, in a sense, legitimized civil disobedience and confrontation with the cops in the current era – an opening that could be exploited. And, if the cameras followed the white people like drones on the kill, then Black outfits should take advantage of the new publicity. The opening that OWS has created for movement politics comes not a moment too soon for African Americans, the group most in need of a movement, and with the deepest historical experience in movement-building."

"The brilliance – if not genius – of the movement, is in the evocation of “occupation” when coupled with the address of the enemy, Wall Street. To many of the participants, “Occupy Wall Street” signifies the elevation of human needs and values over Wall Street profits – a laudable, though amorphous, goal. But to “occupy” the enemy’s camp is to grapple with him for physical and/or political space. Inevitably, that means a struggle whose outcome can only be measured in terms of power. In this arena, left-liberal nostrums of tinkering and accommodation with fundamental evils must fail – and will be seen as inadequate to the struggle, early on."

"The cumbersome horizontal mechanisms of the Occupy movement are, in practice, a prophylactic against co-optation by the Democratic Party – a greater danger than the police. To put it bluntly, OWS practice makes it difficult for the movement to make a “deal” with Wall Street’s minions in the Democratic Party and like-minded circles, even if the weaker reformers in the ranks wanted to – which many do, judging by some of the proposals swirling around the milieu."

"The mostly white OWS movement had, in a sense, legitimized civil disobedience and confrontation with the cops in the current era – an opening that could be exploited. And, if the cameras followed the white people like drones on the kill, then Black outfits should take advantage of the new publicity. The opening that OWS has created for movement politics comes not a moment too soon for African Americans, the group most in need of a movement, and with the deepest historical experience in movement-building."

Lessons for Occupy Wall Street by Beverly Gage

"As they sort out what to do next, the Occupiers might take a page from the history of American labor, the only social movement that has ever made a real dent in the nation’s extremes of wealth and poverty. For more than half a century, between the 1870s and the 1930s, labor organizers and strikers regularly faced levels of violence all but unimaginable to modern-day activists. They nonetheless managed to create a movement that changed the nation’s economic institutions and reshaped ideas about wealth, inequality, and Wall Street power. Along the way, they also helped to launch the modern civil liberties ethos, insisting that the fight to tame capitalism went hand in hand with the right to free speech."

"If there is one lesson for Occupiers to take from the early history of American labor, it is that making real changes in the structures of wealth and power in this country is likely to be a long, hard slog."

"If there is one lesson for Occupiers to take from the early history of American labor, it is that making real changes in the structures of wealth and power in this country is likely to be a long, hard slog."

Shifting the Conversation from “National Deficit” to “Personal Debt”